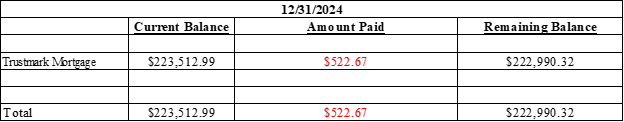

At the end of 2024, I have a lot to be thankful for. I completed my first true full year of production as a mortgage loan officer. I was able to reconcile a relationship in which I behaved poorly, and Jill and I are debt free except for the mortgage again. Credit card debt if you don’t completely cut them out of your life will be a consistent ebb and flow. Do I recommend being in credit card debt? I don’t. If you use credit cards, then you are playing a risky game. If you have the discipline to stick to your budget, make sure you have life insurance in place, have emergency savings of 3 months’ worth of income, then I feel like you can take that risk. I continue to be an advocate of the three-fold path: Dave Ramsey’s no debt way (7 baby steps), low leverage (20% LTV – 80% down)/paying credit cards that carry a balance within 3 months, and the self-lending way. We moved money from our savings account to pay this card off, and I will be paying this transfer back at an interest rate of 18% over 24 months. I deposit the funds back into a high yield savings account so not only am I recapturing the interest, but I’m gaining interest off what I’ve recaptured. In the end, all my financial plans are for nothing if I’m not preparing a foundation for my children’s children and have my eyes on eternity. Our lives are a vapor and pass a lot faster than we imagine. Do you think about life beyond debt free?

If you want to learn more about the self-lending principle or if you need a financial check-up, then contact me.

“The LORD will send rain at the proper time from his rich treasury in the heavens and will bless all the work you do. You will lend to many nations, but you will never need to borrow from them.”

Deuteronomy 28:12 NLT

http://bible.com/116/deu.28.12.nlt

I believe in your journey to….

A Debt Free Me